A Comprehensive Overview of Waaree Energies

In the rapidly evolving renewable energy landscape, Waaree Energies Ltd. stands out as a noticeable player in India’s solar energy sector. With an Initial Public Offering (IPO) on the horizon, investors and market analysts are closely watching this development. This article digs into the key aspects of Waaree Energies’ IPO while giving you the company’s background, market position, financial health, and what this IPO could mean for stakeholders.

Waaree Energies – Company Background

Founded in the year 1989, Waaree Energies is a leading manufacturer of solar photovoltaic (PV) modules in a developing country like India. The company has further expanded its operations to include a wide range of services, from solar project development and engineering to design and installation. With a strong commitment to sustainability, Waaree Energies has established itself as a trusted name in the renewable energy sector, boasting a production capacity of over 2 GW per annum.

Waaree Energies – Market Position

The Indian solar market has witnessed exponential growth, driven by government initiatives and a shift toward clean energy. In the near-term of 5 years, the country is set to witness a projected CAGR upwards of 7.5% as per prominent market insight reports. Waaree Energies is well-positioned to capitalize on this trend, being one of the largest players in the Indian industry. The company’s extensive portfolio includes utility-scale solar projects, rooftop solutions, and off-grid solar applications.

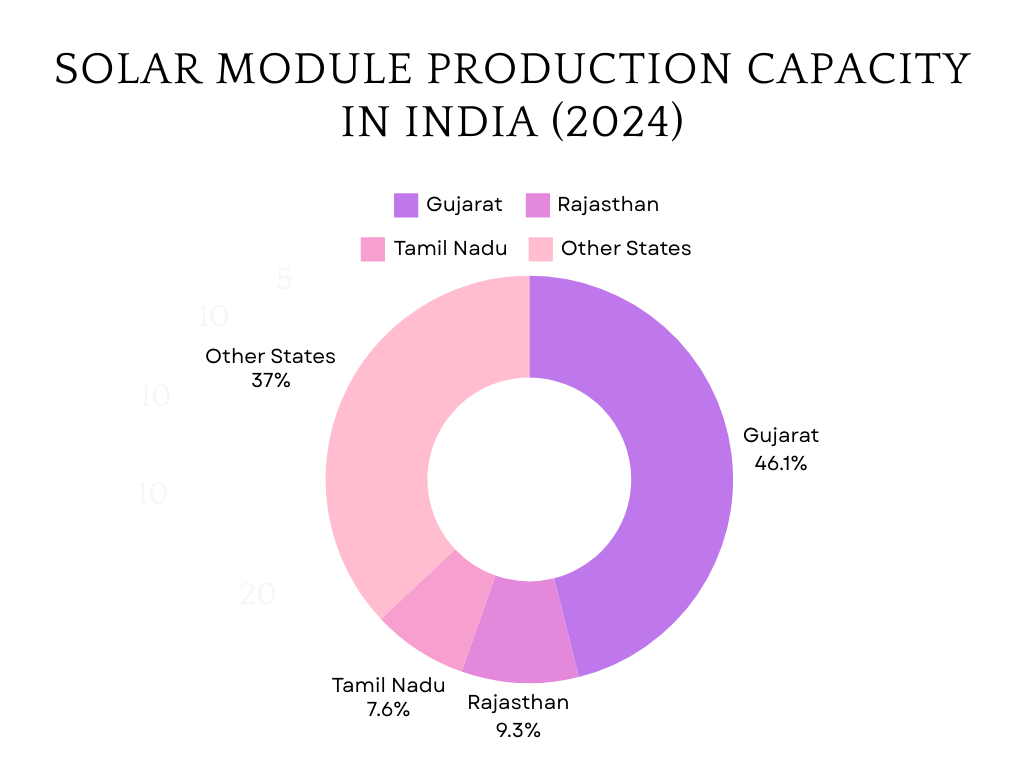

As of recent reports, Waaree holds a significant market share in solar module manufacturing and is recognized for its quality and innovative products. Waaree has India’s largest aggregate installed capacity of 12 GW as of June-2024 at its various plants in Gujarat. In India, Gujarat holds a leading position in solar module production capacity of approx. 46.1% followed by Rajasthan and Tamil Nadu with 9.3% and 7.6% respectively. Karnataka, Telangana, Haryana, West Bengal, Uttar Pradesh, Maharashtra, Uttarakhand, etc. are some of the states following this list of solar module production as per capacity.

Waaree Energies – Financial Performance

Waaree Energies has showcased solid financial performance over the years. Its revenue streams are diversified, stemming from manufacturing, project execution, and after-sales services. In recent fiscal reports, the company has shown consistent growth in revenue and profit margins, supported by increasing demand for solar energy solutions. Key financial highlights include:

Revenue Growth: A consistent year-on-year increase in sales, driven by both domestic and international orders.

Profitability: Stable profit margins reflecting operational efficiency and cost management.

Strong Order Book: A robust pipeline of ongoing and upcoming projects enhances future revenue visibility of the company.

Waaree Energies – IPO Details

The IPO is set to offer investors an opportunity to participate in the company’s growth story. Waaree Energies IPO size is Rs. 4,321.44 crores. The issue is a combination of fresh issue of 2.4 crore shares aggregating to Rs. 3,600.00 crores and offer for sale of 0.48 crore shares aggregating to Rs. 721.44 crores. The expectations are high regarding investor interest. Price band for the IPO is set at Rs. 1427 to Rs. 1503 per share and a minimum lot size of 9 shares. The minimum investment amount required by retail investors is Rs. 13,527. The IPO could attract a wide range of institutional and retail investors, given the rising emphasis on sustainable energy and the company’s established market presence.

| Book built issue | Rs 4,321.44 crores |

| Type of issue | Combination issue

· Fresh issue of 2.4 crore shares (Rs. 3,600.00 crores) · Offer for sale of 0.48 crore shares (Rs. 721.44 crores) |

| IPO Opening Date | Monday, October 21, 2024 |

| IPO Closing Date | Wednesday, October 23, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on Wednesday, October 23, 2024 |

| Allotment Basis | Thursday, October 24, 2024 |

| Refund Initiations | Friday, October 25, 2024 |

| Shares Credited to Demat | Friday, October 25, 2024 |

| Listing Date | Monday, October 28, 2024 |

| Listing on | NSE, BSE |

| Price band | Rs. 1427 to Rs. 1503 per share |

| Minimum lot size | 9 Shares |

| Minimum investment amount required by retail investors | Rs. 13,527 |

| Minimum lot size investment for sNII | 15 lots (135 shares)

= Rs. 202,905 |

| Minimum lot size investment for bNII | 74 lots (666 shares)

= Rs. 1,000,998 |

Investment Considerations

Investing in Waaree Energies’ IPO comes with both potential rewards and risks. Here are some key factors to consider:

- Growth Potential: With the Indian government’s commitment to increasing renewable energy capacity, Waaree Energies positions to benefit significantly from policy support and market expansion.

- Technological Advancements: The Company’s focus on innovation and technology enhances its competitive edge, thus making it a key player in a rapidly changing market.

- Industry Competition: The renewable energy sector is becoming increasingly competitive, with several players competing for market share. Waaree Energies must continue to differentiate itself through quality and service.

- Regulatory Environment: Investors should monitor any changes in government policies or incentives related to solar energy, as these can directly impact the company’s performance.

Conclusion

The upcoming IPO of Waaree Energies Ltd. is an exciting development in the renewable energy sector. As a leader in solar energy solutions, the company is well-positioned to harness the growing demand for clean energy in India as well as beyond. Investors looking to participate in this IPO should conduct thorough research and consider both the opportunities and challenges that lie ahead. With a strong foundation and a clear growth strategy, Waaree Energies is poised to play a significant role in shaping the future of renewable energy in India.

Is it worth of Rs. 1500/- per share considering that company can complete its 80% of goals of one year?

To determine if Waaree Energies share price of Rs. 1500 is justified, consider several factors:

Financial Performance: Analyzing recent earnings reports, revenue growth, and profit margins, Waaree Energies is consistently meeting and trying to exceed targets, that supports a higher valuation.

Market Position: Waaree Energies’ position in the renewable energy sector is crucial. If it has a strong market share and competitive advantages, this can justify a higher price.

Future Prospects: Consider growth potential, especially with the increasing demand for renewable energy, Waaree Energies’ showcases plans for expansion and its abilities to execute those plans.

Valuation Metrics: The company’s financials and ratios are promising compared to the industry medians.

If the company is expected to achieve 80% of its goals and has solid fundamentals and market prospects, a share price of Rs. 1500 might seem reasonable. However, thorough analysis and comparison with industry standards are essential before making investment decisions.

PS – This is not an investment advise. This is just for educational purpose.

Can HNI sell on listing?

Yes