Introduction

NTPC Limited, India’s largest energy conglomerate, is set to make its step towards a brighter future with its NTPC Green Energy IPO. It is an important part of the strategy by NTPC to further strengthen the green energy portfolio in general in increasing harmony with Indian commitments towards clean energy and global sustainability targets. The current IPO is also highly significant both for the company and investors looking to enter this fast-growing renewable energy market.

Company Profile

NTPC Limited

The NTPC Limited, also formerly known as National Thermal Power Corporation, is a company established in the year 1975. As of today, NTPC remains India’s largest power producing company, having achieved a total installed capacity of over 70,000 MW. The business mainly deals with the thermal, hydro, and renewable energy sectors and has expanded its area of interest in the sustainable energy landscape. Having covered a significant distance in the growth of its renewable energy capacity, NTPC has declared that it will further boost its green portfolio.

The company’s key areas of operation include:

- Thermal Power Generation: For NTPC, thermal power generation is at the very heart of its business. This is a significant portion of its total installed power generation capacity.

- Renewable Energy: NTPC is aggressively expanding its portfolio of renewable energy, including highly focused development of solar, wind, and hybrid energy projects. By 2032, the company aims to source 30% of its total capacity from renewables.

- Power Trading: The entities that NTPC possesses are also trading in power. It enables them to maximize the efficient distribution across India.

NTPC Green Energy Limited (NTPC GEL)

NTPC Green Energy Limited is a 100 per cent subsidiary of NTPC Limited, one of the largest energy-intensive groups in India. The focus area for NTPC Green primarily includes the development, generation, and management of renewable energy projects. This is part of the total roadmap for NTPC towards a more sustainable, low-carbon future by significantly increasing its capacity in renewable energy.

Key Highlights of NTPC Green Energy Limited:

- Formation and Ownership:

NTPC Green Energy Limited was established as a subsidiary of NTPC Limited to accelerate the adoption of renewable energy sources in line with India’s climate goals and NTPC’s vision of becoming a leader in clean energy.

- Focus Areas:

NTPC Green Energy Limited is primarily involved in solar power, wind power, and hydropower projects. It is also focused on the development of green hydrogen initiatives and exploring other renewable energy solutions such as battery energy storage systems (BESS) to support grid stability and storage of renewable energy.

- Renewable Energy Capacity:

NTPC is already one of the largest renewable energy players in India, with a substantial portion of its installed capacity coming from renewable sources. The company aims to achieve 60 GW of renewable energy capacity by 2032, with NTPC Green playing a central role in reaching this target.

- Strategic Goals:

- Decarbonisation: NTPC Green is committed to decarbonizing its power generation portfolio by increasing the share of renewables in its total installed capacity.

- Sustainability: The Company is dedicated to contributing to India’s climate goals, including achieving net-zero carbon emissions by 2070.

- Clean Energy Leadership: It aims to become a leading green energy player in the country, focusing on large-scale renewable projects, solar and wind hybrid solutions, and emerging green technologies such as hydrogen.

- Key Projects:

NTPC Green Energy is actively involved in the development of large-scale solar and wind farms. Some of its notable projects include:

- Solar Parks: NTPC has been setting up large-scale solar parks in various states in India, such as Rajasthan, Gujarat, Telangana, and Uttar Pradesh.

- Wind Power Projects: The Company is also expanding its wind energy portfolio with several wind farms across India.

- Green Hydrogen: NTPC is exploring and working on pilot projects for green hydrogen production, which will support both its decarbonisation efforts and the broader transition to clean energy in India.

NTPC Green Energy IPO Details & Timeline

The NTPC Green Energy IPO is a move to list NTPC’s green energy subsidiary, NTPC Green Energy Ltd (NGEL), which will allow the company to raise capital specifically for renewable energy projects.

Key details of the IPO:

| DETAILS | INFORMATION |

| Company Name | NTPC Green Energy Limited |

| NTPC Green Energy IPO Issue Type | Entirely Fresh Issue |

| NTPC Green Energy IPO Issue Size | Rs. 10,000 Crores (92.59 Crore Shares) |

| NTPC Green Energy IPO Dates | November 19, 2024 to November 22, 2024 |

| Face Value | Rs. 10 per share |

| Price Band | Rs. 102 – Rs. 108 |

| Lot Size | 138 Shares |

| Minimum amount of investment required by retail investors | Rs. 14,904 |

| Listing at | NSE, BSE |

| Employee Discount | Rs. 5 per share |

Timeline of the NTPC Green Energy IPO:

| NTPC Green Energy IPO Open Date | Tuesday, November 19, 2024 |

| NTPC Green Energy IPO Close Date | Friday, November 22, 2024 |

| o Cut-off time for UPI mandate confirmation | 5 PM on November 22, 2024 |

| Basis of Allotment | Monday, November 25, 2024 |

| Initiation of Refunds | Tuesday, November 26, 2024 |

| Credit of Shares to Demat | Tuesday, November 26, 2024 |

| Listing Date | Wednesday, November 27, 2024 |

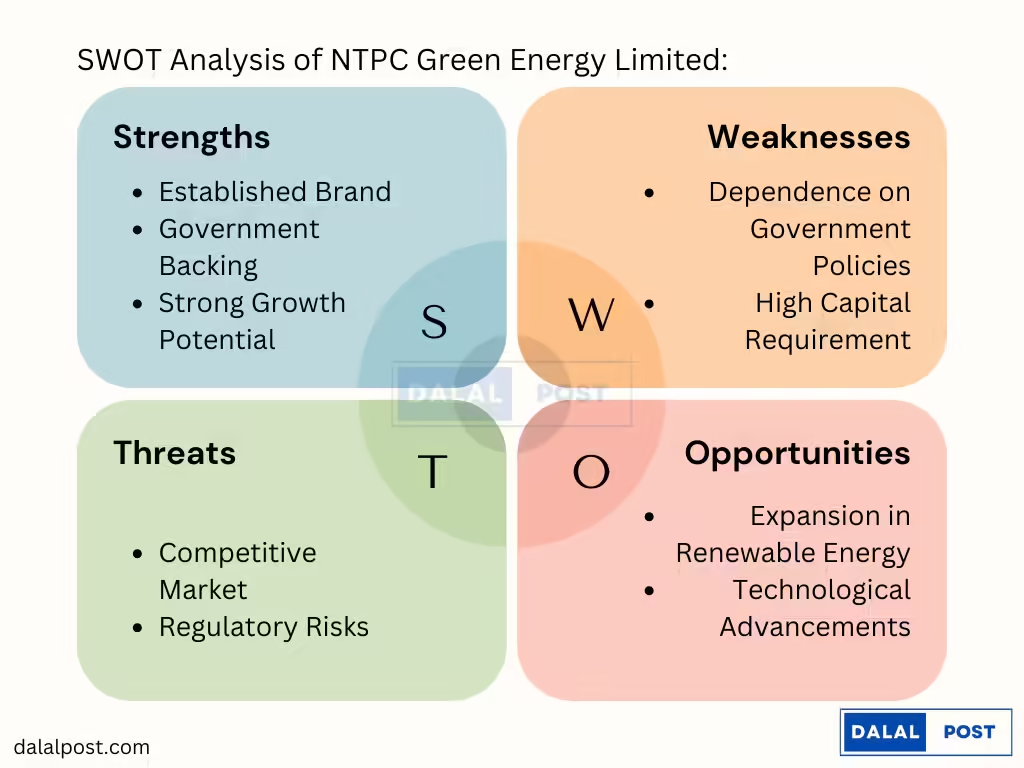

NTPC Green Energy SWOT Analysis (Strengths – Weaknesses – Opportunities – Threats)

Strengths

- Established Brand: As a subsidiary of NTPC, NTPC Green Energy IPO benefits from the parent company’s reputation, financial stability, and market presence.

- Government Backing: The green energy initiatives supported by the Indian government make NTPC Green have an added boost in credibility, because India has set aggressive targets for its renewable energy portfolio at 500 GW by 2030.

- Strong Growth Potential: NTPC Green is positioned to capitalize on India’s increasing demand for renewable energy. The country’s renewable energy market is projected to grow at a CAGR of over 20% from 2022 to 2030.

Weaknesses

- Dependence on Government Policies: NTPC Green’s projects are highly dependent on government policies related to renewable energy tariffs, subsidies, and support.

- High Capital Requirement: The need for continuous investments in infrastructure, research, and development could result in higher debt levels or lower profitability in the early years.

Opportunities

- Expansion in Renewable Energy: With India’s commitment to achieving net-zero emissions by 2070, the renewable energy sector is poised for rapid growth. NTPC Green has an opportunity to dominate the market as one of the largest players.

- Technological Advancements: Advancements in energy storage, smart grids, and hybrid energy solutions can provide NTPC Green Energy with a competitive edge.

Threats

- Competitive Market: The renewable energy market in India is highly competitive, with major players such as Adani Green, ReNew Power, and Tata Power expanding aggressively.

- Regulatory Risks: Changes in energy policies or delayed approvals for projects could impact NTPC Green’s growth prospects.

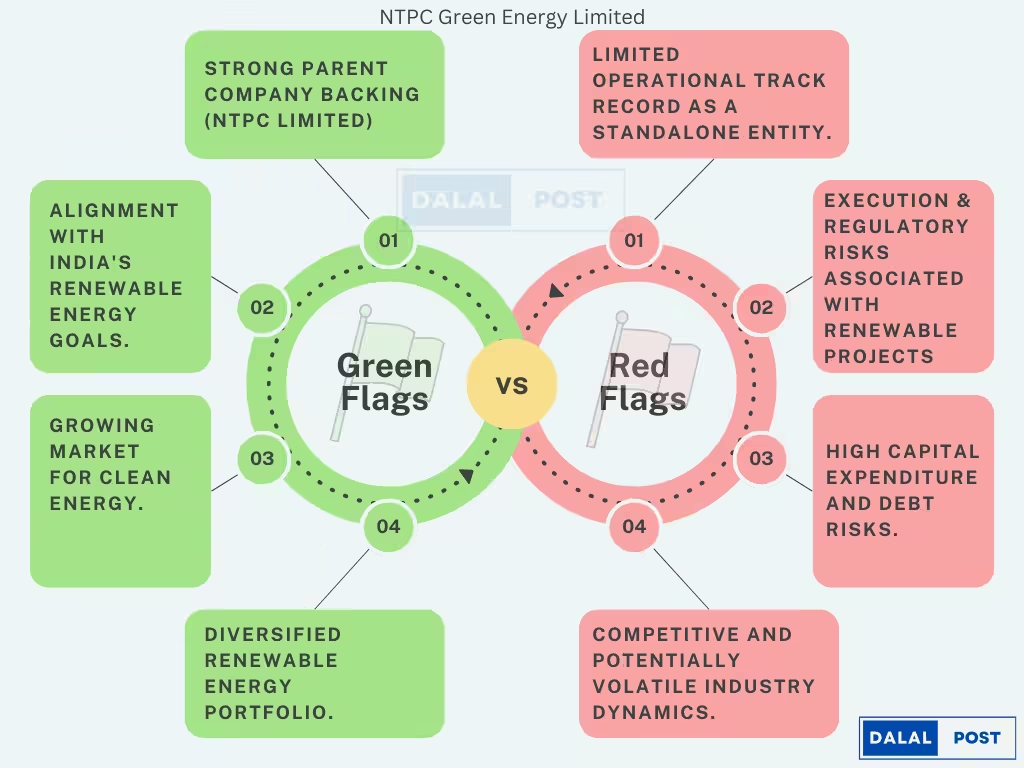

NTPC Green Energy Green Flags & Red Flags

Green Flags (Positive Indicators)

- Strong Parent Company – NTPC Limited: The parent company is NTPC Limited, the largest power generation company from India. NTPC has a reliable and robust position with an extremely good reputation for energy generation with a serious financial condition. The presence of such a strong parent company gives a feeling of solidity and confidence.

- Renewable Energy Focus: With a world push towards clean energy and sustainability, the demand for renewable energy shall climb sharply over time. NTPC Green Energy, focused on solar, wind, and other renewable sources of energy, is well placed to ride such long-term trends.

- Government Support for Renewable Energy: India’s government has committed to achieving net-zero emissions by 2070 and has set ambitious renewable energy targets, including 500 GW of non-fossil fuel-based energy capacity by 2030. NTPC Green Energy stands to benefit from policy support, incentives, and subsidies for renewable energy development.

- Diversified Portfolio of Renewable Energy Projects: The Company is expected to have a diversified portfolio, spanning across solar, wind, and other renewable energy ventures. A diversified project base can provide stability and reduce risk.

- Growing Renewable Energy Capacity: NTPC Green Energy is expected to have an expanding pipeline of projects and long-term contracts (including Power Purchase Agreements or PPAs) with government agencies and private clients. This can provide predictable cash flow and growth.

- Reasonable Valuation: The NTPC Green Energy IPO is priced reasonably compared to its peers in the renewable energy sector, this represents an attractive entry point for investors, especially those looking to gain exposure to clean energy.

Red Flags (Concerns or Risks)

- Limited Track Record as a Separate Entity: Although NTPC Green Energy benefits from the experience of NTPC, as an independent company, its operating history will be extremely short – especially with regards to scaling up renewable projects, managing risk in the renewable sector, and access to all financial markets.

- Execution Risk: Many large-scale renewable energy projects, such as large-scale solar and wind installations, are complicated and require a lot of capital and time to build. There is the execution risk concerning meeting their timelines, costs, and technical challenges, which could influence profitability and project returns.

- Regulatory Risks: Renewable energy is highly dependent on government policies, subsidies, and incentives. Any change in the government’s policy, delays in approvals, or unfavourable regulatory change could significantly dent the profitability of NTPC Green Energy projects.

- High Capital Expenditure (CapEx): Renewable energy infrastructure requires substantial upfront capital investment. This may result in a high debt level or equity dilution if the company needs to raise more funds in the future. Higher debt can further exacerbate financial risks, particularly in the growth phase.

- Dependence on Weather and Seasonality: Solar and wind energy generation is highly dependent on weather patterns. For example, a low wind or cloudy season can result in reduced energy generation, affecting the company’s revenue and cash flows.

- Competitive Industry Landscape: The renewable energy industry is highly competitive with many players entering the industry. NTPC Green Energy will compete with other established players and new entrants that may occupy market share or reduce its ability to gain a profit.

- Environmental Risks: While renewable energy is cleaner than fossil fuels, mega solar and wind projects still face environmental challenges. Problems such as land acquisition, environmental impact assessments, and resistance from local communities tend to delay and make them more costly.

Conclusion

NTPC Green Energy IPO is an attractive investment opportunity, especially for portfolios seeking to be made green and future-proof. The market position seems strong with government support and a defined green energy strategy. NTPC Green therefore stands out as a leader in renewable transition in India. Investors must balance against the risks arising from competition, regulatory difficulties, and highly capital-intensive nature in this space.

As India picks up the momentum in renewable energy targets, NTPC Green Energy’s performance is going to become a very vital area of the energy landscape. This may turn out to be an important growth area for investors seeking compounded returns over long time frames. Looking at the current market correction, NTPC Green Energy IPO looks good in long term perspective and holds strength to double its value in future 3 – 5 years of time period.

NTPC (Parent Company): https://ntpc.co.in/

NTPC Renewable Energy Limited: https://ntpcrel.co.in/