Introduction

In the Indian stock market, investors are always in search of multibagger stocks. These are companies that deliver returns significantly higher than the initial investment. One such candidate that has caught the eye of analysts and investors alike is Taparia Tools Limited. With a solid foundation in the manufacturing sector and promising growth metrics, Taparia Tools appears to have the characteristics of a potential multibagger.

Company Overview

Taparia Tools Limited is an Indian company mainly engaged in manufacturing and marketing a wide range of hand tools. The company was established in 1969 (50 years industry experience). Taparia Tools Limited has carved a niche for producing superior-quality hand tools for usage across various industries such as the automotive, construction, and general engineering industries. Taparia Tools is a leading company in the hand tool market of India.

| · Name: Taparia Tools Limited |

| · Founded: 1969 |

| · Industry: Manufacturing (Hand Tools) |

| · Headquarters: Mumbai, Maharashtra, India |

· Key Products:

|

| · Brand Presence: Strong presence in the Indian market along with exports to around 2 dozen countries such as U.K., The US, Denmark, Israel, Germany, Sweden, Norway, Finland, Dubai, Kuwait, Tanzania, Kenya, Hong Kong, Thailand, Mexico, Argentina, Uruguay, U.A.E, Sri Lanka, etc. |

Financial Performance

Revenue Growth

- For the year ended 31st March 2024, Taparia Tools generated an annual income of 829 Crores compared to its previous year i.e. Rs. 764 Crores. Such a significant growth represents an increase of approx. 8.95% over the previous year. This trend of growth is all the more impressive against the backdrop of the pandemic and supply chain disruptions that were caused throughout the world.

- The total comprehensive income after tax is 100.34 Crores in the current year (2023-2024) which represents an increase of 39.20% against that of the previous year.

Net Profit Margin

Currently, the average net profit of Taparia Tools Limited is Rs. 82.85 Crores. The net profit percentage for this year is 8.44%. That is healthy within the manufacturing sector, given it represents effective cost controls as well as a stable price set.

Ratios Comparisons

| RATIOS | 2023-2024 | 2022-2023 | CHANGE |

| Current Ratio (Times) | 4.27 | 4.27 | No change |

| Return on Investment (%) | 4.01 | 3.25 | 23.38 |

| Return on Capital Employed (%) | 32.70 | 35.77 | (8.58) |

| Return on Equity Ratio (%) | 31.51 | 26.75 | 17.79 |

| Inventory Turnover Ratio (Times) | 4.48 | 3.30 | 35.76 |

| Trade Receivable Turnover Ratio (Times) | 11.46 | 11.75 | (2.47) |

| Trade Payable Turnover Ratio (Times) | 9.06 | 11.98 | (24.37) |

| Net Capital Turnover Ratio (Times) | 2.85 | 3.17 | (10.09) |

| Net Profit Ratio (%) | 8.44 | 9.46 | (10.78) |

Share Price & Market Capitalization

| Year | 2024 | 2023 |

| Market Price per Share (Rs.) | 3.70 | 10.50 |

| Earnings per Share (Rs.) | 65.73 | 47.65 |

| P/E Ratio | 0.056 | 0.044 |

| Market Capitalisation (Rs. in Crores) | 56.16 | 31.87 |

| Percent Change (%) | 76.22 | 4.72 |

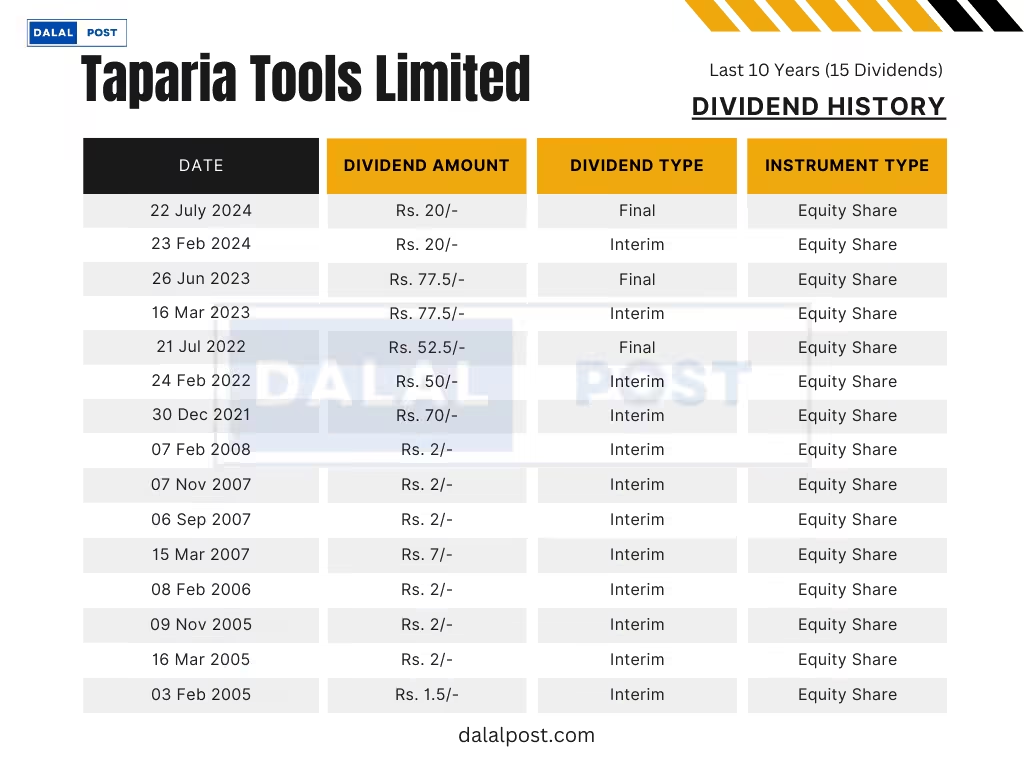

Dividend History & Yield

- Since March 06, 2002, Taparia Tools Limited has declared 22 dividends, amounting to a total of 398.50/- dividend per share. (2002 to 2024)

- Since the past 1 year, the company has declared an equity dividend amounting to 40/- per share.

- At the CMP (current market price) of Rs. 8.35/- per share, Taparia Tools Ltd.’s dividend yield is 479.04%

Growth Potential

Product Diversification

Taparia is aggressively looking at diversifying products in a way that can tap the emerging trends of markets. It has plans to introduce new technologically advanced lines for both professionals and consumers. This would help it diversify and find a new stream of revenues to be achieved through growth.

| New Products Launched in 2023-2024 |

|

| Additional Varieties in Existing Product Group |

|

Export Opportunities

Currently, exports contribute a large chunk to the revenues of Taparia. It is ambitious to see how Taparia plans to grow exports up within the next five years. Growth in global demand for quality tools has been seen especially in developed markets, and thus the approach might add a great deal of value to revenue and profit lines.

R&D and Innovation

Competition comes with R&D investing. Taparia enhanced their R&D budget by spending a good amount of approx. Rs. 245 lakhs i.e. 0.29% of its total turnover on their research and development activities. Innovation, as is widely known, is what has helped successful multibaggers; here are the companies that anticipate before a trend comes about and hits the market.

Dangers in the Headwind

Even though there is considerable potential for growth, inherent risks persist from an investor’s standpoint in Taparia Tools. The manufacturing industry largely faces issues, namely economic slowdowns, volatile raw material prices, and intense competition. Additionally, any resultant delay in the implementation of its growth strategies also impacts performance.

SWOT Analysis (Strengths – Weakness – Opportunities – Threats)

Strengths:

Brand Recognition & Reputation:

Taparia Tools has built a fine brand reputation over the years as a quality, long-lasting hand tool manufacturer. It has gained the confidence of its customer base, mainly in India.

Wide Product Range:

The company has a diversified range of hand tools, such as screwdrivers, pliers, wrenches, hammers, etc. Diversification reduces dependence on one product category.

Strong Distribution Network:

Taparia Tools has an effective distribution network, not only in India but outside the country as well. This has helped the company to cover a huge customer base at all levels whether it is professionals, retail customers, or industrial clients.

Quality Control & Certification:

The Company maintains quality control checks and international certifications like ISO, etc. that help in building up credibility in the marketplace.

In-house Manufacturing:

The majority of products of Taparia Tools are manufactured in-house. The benefits of this would include better control over quality, cost, and the lead times for producing such goods.

Weaknesses

Limited Global Presence:

Although Taparia Tools enjoys an Indian brand and small niche markets across international destinations, its footprint on an international scale is still way short of many other competing global brands like Stanley, Bosch, or Craftsman. This makes it rather tough to tap new markets easily.

Dependence on Indian Market:

A large part of the company’s revenue comes from the domestic market. Economic slowdowns, changing consumer preferences, or regulatory changes in India could adversely impact its sales.

Lack of Innovation in Product Design:

While Taparia has a solid product portfolio, its tools might not be as innovative or technologically advanced as some of its global competitors. Lack of focus on design improvements may limit appeal to younger or more tech-savvy consumers.

Pricing Pressure:

The company operates in an extremely crowded market with very large numbers of domestic players and also many international competitors. It will result in price pressures, especially the entry-level products, impacting profit margins.

Opportunities:

Growing Demand in DIY Market:

DIY is increasingly growing in India and the other countries as well. Sourcing of hand tools that will be used to fix and at home are observed. In this case, Taparia could capitalize upon the same with more tailored and user-friendly products.

International Expansion:

There is an immense scope for this company’s expansion at the international level, especially in developing countries with emerging infrastructure and industrial development. Africa, Southeast Asia, and Latin America should be considered.

Technological Advancements:

This company needs to invest in automation, state-of-the-art manufacturing process, and ergonomic design for tools and can be benefited in all the areas. It might allow this company to raise productivity, reduce the costs of the product, and improve quality products.

E-Commerce Growth:

As e-commerce grows globally, Taparia Tools can strengthen its online sales channels in the domestic as well as international markets to reach more customers and acquire new ones.

Green and Sustainable Products:

Growing global interest in sustainability offers an opportunity for Taparia to innovate by introducing eco-friendly tools or products made from sustainable materials, which is in tune with the growing environmental consciousness among consumers.

Threats

Intense Competition:

It has very high competition in it from local as well as from international players, which present almost similar products. Most of the companies, for instance, Stanley, Bosch, Black & Decker and various others, have a massive presence in the market; therefore, Taparia Tools has not been able to be growing with the same speed that was expected.

Fluctuating Raw Material Costs:

The raw materials for production of hand tools (e.g., steel and all metals) are under fluctuations in prices. With such a hike in material price, the profit margins shall get affected.

Economic Downturn:

In case of economic recession or decline, discretionary consumer goods like premium hand tools will have reduced demand. Changing consumer expenditure will affect the sales for Taparia Tools Limited.

Import Dependence:

Despite making most of the products in-house, Taparia has some dependence on imported raw materials or parts. The company would get impacted in case there were disturbances in the supply chain at a global level or some barriers to trade came in.

Changing Consumer Preferences:

Changes in consumer preferences from hand tools to power tools or an increased focus on electric versus manual tools and so forth will reduce demand for Taparia products, unless they diversify the product lines into that segment.

The Real Scenario

There are various reasons behind why the Taparia Tools shares are challenging to purchase in the open stock market. Some of the reasons are stated below:

Low Public Float: Taparia Tools has a low public float of around 30% of the total 1.52 crores shares that are subscribed. This meaning most of the shares are held by the promoters or people closely related to them. This is restraining the shares available for trading in open market and hence hampering its liquidity. In simple words, there are no sellers and only pending buying orders in the market.

High Promoter Holding: Promoters own/hold 69.72% of the total shares and are not selling them, reducing the available supply for public trading. Promoters are not selling these shares as Taparia Tools share price is undervalued with great potential in near future. With such boundless opportunities and growth prospects, the company will see a potential rise in price leading to greater profits in coming years.

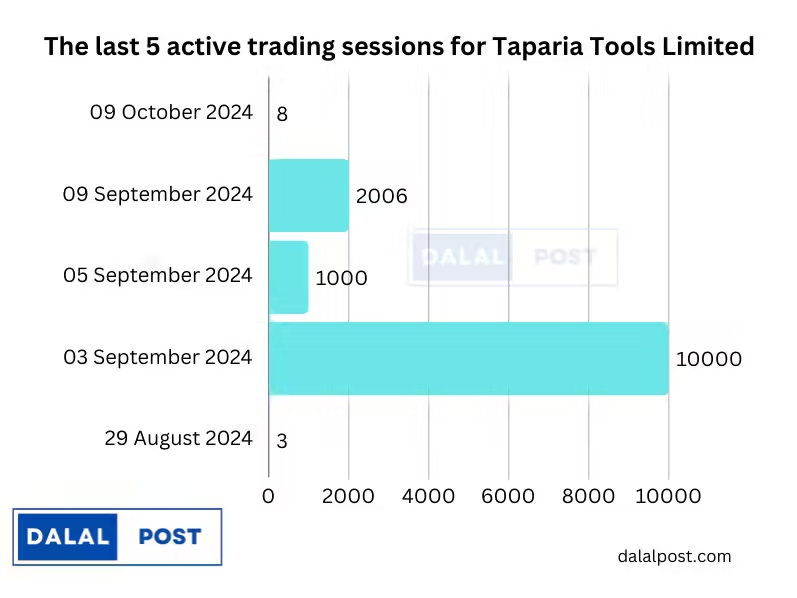

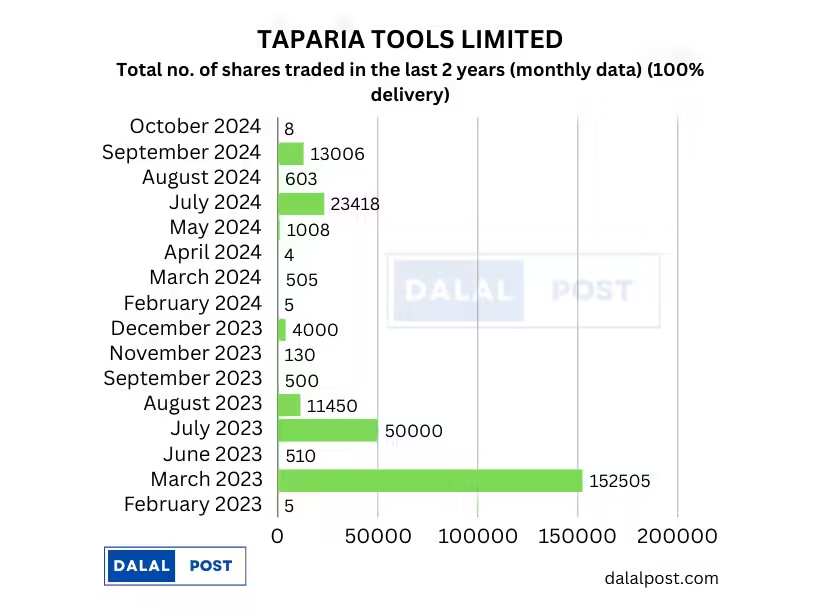

Lack of Liquidity: There is a very low trading volume in Taparia Tools Limited. As of date (10/11/2024), only around 39 thousand shares have been traded in 2024 with a 100% delivery rate. Hence it is very challenging to buy these shares from open market.

The last 5 active trading sessions for the stock has been as shown under.

Delivery quantity and percentage in the last 2 years (monthly)

Conclusion

Conclusion In view of the overall characteristics found in Taparia Tools Ltd, it stands a big chance of emerging as India’s next multibagger stock. Revenues were on a steady growth footing, profitability is improving from a low base, while strategic initiatives that focus towards product diversification and increasing international presence set Taparia up for big returns that investors can gain.

Key Takeaways

- Product range consists of 400 types of hand tools, including wrenches, screwdrivers, pliers, hammers, sockets, and more

- Taparia Tools manufactures over 500 million tools annually, with a wide range of products tailored for both industrial and consumer markets

- Taparia’s tools are available in over 50,000 retail outlets across India

- Taparia Tools exports its products to around 25 countries, including regions such as Europe, Africa, and Southeast Asia

- Taparia employs over 1,200 people across various functions, including manufacturing, research and development, marketing, and customer support

- Taparia Tools has 2 manufacturing plants, one in Nashik and one in Goa

- Taparia Tools presently has over 800 distributors all over India.

- Taparia Tools offers limited lifetime warranties on many of its products, underscoring its confidence in the durability and reliability of its tools

- Tools generally range from 50 to Rs. 3,000 (approx.), depending on the type and complexity of the tool (e.g., basic screwdrivers vs. high-end torque wrenches).

Sources :

https://rc-web.stockedge.com/share/taparia-tools/32?section=prices&exchange-name=bse&time-period=1D

https://www.moneycontrol.com/india/stockpricequote/castingsforgings/tapariatools/TT02