Introduction

Swiggy is one of the leading food delivery platforms of India and is soon preparing for a much-awaited initial public offering (IPO). The swiggy IPO is surely going to attract the attention of many investors and market analysts with the booming growth of the online food delivery sector. Here is a comprehensive overview of all you need to know about swiggy IPO.

Company Overview

Swiggy was founded in the year 2014. The company initiated its primary business operations as a food delivery company and gradually diverged to grocery by launching Swiggy Instamart. Swiggy operates across over 500 cities, catering to millions with a humongous number of affiliated restaurants.

Ecosystem of IPO in India

The Indian IPO market has been very vibrant, with a number of tech-driven companies that made headlines recently. Within the last one year, quite a number of start-ups went public and it shows there is an ideal environment for Swiggy to raise funds in this manner as well. The Swiggy IPO is set to attract interest from both institutional and retail investors.

Factors Contributing to Market Growth

- Roaring Demand: The Indian online food delivery market is likely to grow at a compound annual growth rate (CAGR) of around 30% between 2021 and 2026 and could reach USD 12 Billion in 2026 (Source: Statista).

- Diversification of Services: Grocery and essentials delivery, wherein Swiggy has entered, create additional revenue streams besides food delivery and thereby are also improving market standing.

- Expansion of the Customer Base: According to recent claims, the user base has grown really high. Of course, its monthly active users reached more than 20 Million in 2023 (Source: Economic Times).

Swiggy IPO Details & Timeline

| DETAILS | INFORMATION |

| Company Name | Swiggy |

| Swiggy IPO Date

· Swiggy IPO Open Date · Swiggy IPO Close Date o Cut-off time for UPI mandate confirmation · Basis of Allotment · Initiation of Refunds · Credit of Shares to Demat · Listing Date |

November 6, 2024 to November 8, 2024

· Wednesday, November 6, 2024 · Friday, November 8, 2024 o 5 PM on November 8, 2024 · Monday, November 11, 2024 · Tuesday, November 12, 2024 · Tuesday, November 12, 2024 · Wednesday, November 13, 2024 |

| Swiggy IPO Size | Estimated at Rs. 11,327.43 crores (290,446,837 shares) |

| Type of Offering | Fresh Issue and Offer for Sale |

| Fresh Issue Size | Rs. 4,499.00 crores (11.54 crore shares) |

| Offer for Sale Size | Rs. 6,828.43 crores (17.51 crore shares) |

| Price Band | Rs. 371 – Rs. 390 per share |

| Lot Size | 38 Shares |

| Minimum investment amount required by retail investors | Rs. 14,820 |

| Face Value | Re. 1 per share |

| Listing Exchange | NSE and BSE |

Size and Valuation: Swiggy IPO is likely to mop up between USD 1 – 1.5 Billion, valuing the company at around USD 10 Billion. As per Financial Express, this valuation puts Swiggy among India’s top tech companies.

Use of Proceeds: The proceeds from the IPO are likely to be used for the following purposes:

- Market Expansion: The money will be used to expand into new cities and strengthen delivery capabilities.

- Technological Upgradation: Massive amount would be spent to make technology infrastructures more user-friendly.

- Marketing Strategy: Build a brand value by target market capturing new customers.

Swiggy IPO: Green Flags & Red Flags

Green Flags

- Strong Market Position: Swiggy is a leading player in the Indian food delivery market, with significant market share and brand recognition.

- Growing User Base: An expanding customer base indicates increasing demand for its services.

- Revenue Growth: Strong and consistent revenue growth can signal a healthy business model.

- Diversification: Expansion into grocery delivery and other verticals can reduce dependency on food delivery alone.

- Technological Innovation: Investments in technology for logistics and customer experience can enhance efficiency and user satisfaction.

- Strategic Partnerships: Collaborations with restaurants and other businesses can strengthen its market position.

Red Flags

- High Valuation: If the IPO valuation is perceived as excessively high compared to competitors or industry standards, it could indicate overvaluation risks.

- Profitability Concerns: Continued operating losses or a lack of a clear path to profitability can be a concern for investors.

- Regulatory Risks: Changes in regulations affecting food delivery services could impact operations.

- Intense Competition: The presence of strong competitors like Zomato can threaten market share and profitability.

- High Customer Acquisition Costs: If acquiring new customers is becoming increasingly expensive, it may affect future profitability.

- Dependency on Discounts: Relying heavily on discounts and promotions to attract users can be unsustainable in the long run.

Risks and Challenges

It has a highly competitive Indian food delivery market with key players such as Zomato and new entrants in the market constantly vying for market share, impacting the profitability of Swiggy.

Regulatory Environment: Changes in food delivery regulations, labour laws, or policies related to gig workers could create operational issues for Swiggy.

Path to Profitability: Although Swiggy has seen incredible revenue growth, most startups in the tech world face this challenge of maintaining a path to profitability (source: The Hindu Business Line).

Conclusion

The much-awaited Swiggy IPO is among the list of the most significant events expected in the Indian stock market. It will mark a milestone in the landscape of tech companies. The interest from the investors would be high in the growth of the food delivery sector and diversified business model of Swiggy. However, the potential investors must look into the inherent risks and conduct thorough research before investing in the IPO. Swiggy’s journey as a publicly traded company is to be keenly observed with this dynamic player in the food delivery market.

Key Information:

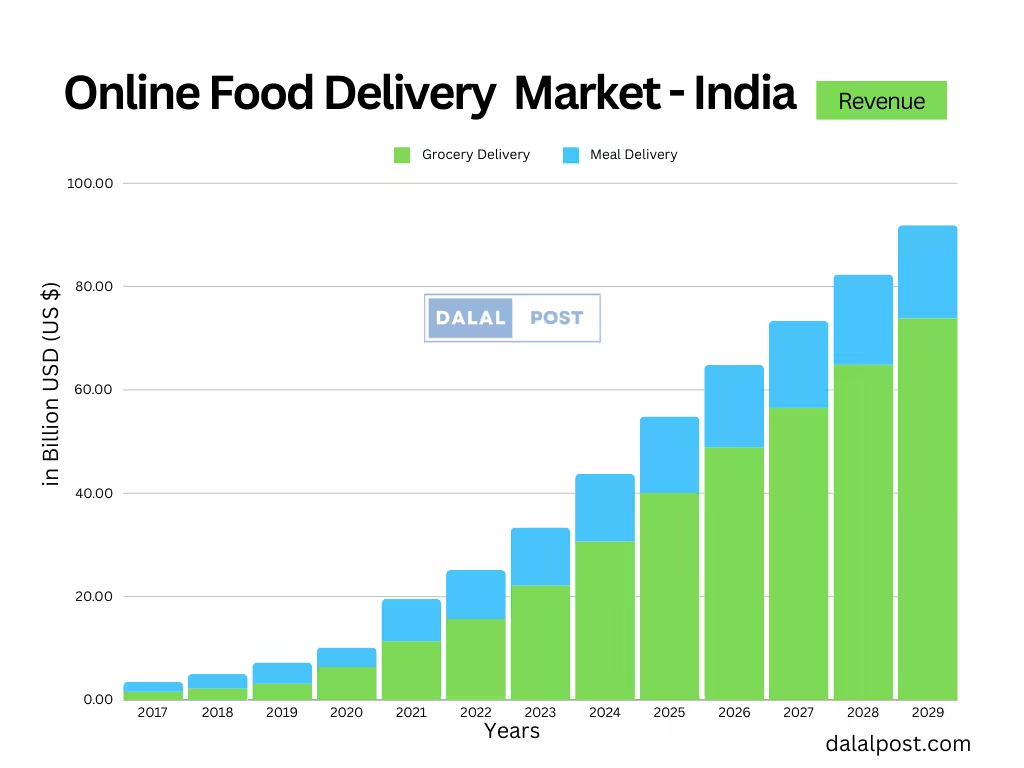

The Online Food Delivery Market in India is anticipated to achieve a revenue of USD 43.78 Billion by 2024, with an expected annual growth rate (CAGR 2024-2029) of 15.98%. This growth trajectory is projected to lead to a market volume of USD 91.88 Billion by 2029.

In the Grocery Delivery sector, revenue is forecasted to increase by 30.7% in 2025, with a projected market volume of USD 30.65 Billion in 2024.

In a global context, China is set to generate the highest revenue in the Online Food Delivery Market, reaching USD 450.50 Billion in 2024.

The average revenue per user (ARPU) in India’s Grocery Delivery Market is expected to be USD 183.40 in 2024.

Furthermore, the Meal Delivery Market in India is predicted to grow to 351.2 Million users by 2029, with user penetration estimated at 18.3% in 2024.

India’s online food delivery sector is rapidly expanding, driven by a rising demand for convenience and a diverse array of available cuisines.

How much listing gain can we expect from SWIGGY IPO ?

Approximately 3-5% only